The Monetary Policy Committee (MPC) of the Bank of Ghana has announced a reduction of the policy rate by 350 basis points, bringing it down from 25% to 21.5%.

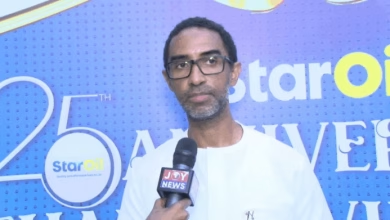

Governor Dr. Johnson Asiama made the announcement following the committee’s 126th meeting on September 17, 2025.

Dr. Asiama explained that the committee expects inflation to continue declining by the end of the fourth quarter.

“The committee’s outlook indicates that headline inflation will ease further in the near term, with expectations of a drop to around 8%, plus or minus 2%, by the end of the fourth quarter,” he stated.

“Based on this projection, the Committee, by majority vote, decided to lower the Monetary Policy Rate by 350 basis points to 21.5%. The MPC will continue to monitor macroeconomic trends closely and adjust policy as necessary to support the disinflation process,” he added.

However, the Governor cautioned that a potential increase in utility tariffs could introduce upward price pressures in the medium term, which may affect inflation.

For instance, the Electricity Company of Ghana (ECG) has requested the Public Utilities Regulatory Commission (PURC) to approve a 225% hike in its Distribution Service Charge.

Despite this, the majority of committee members agreed to reduce the policy rate from 25% to 21.5%.

Regarding the Ghanaian cedi, Dr. Asiama emphasized its strength among global currencies, attributing this to the Bank’s prudent monetary policy.

“The cedi remains one of the strongest currencies worldwide year-to-date, reflecting sound monetary policy, effective liquidity management, fiscal consolidation, and increased foreign exchange inflows,” he noted.

He further assured that the Bank of Ghana is actively monitoring the currency’s performance and implementing regulatory measures to preserve its stability.