“Delays Will Not Be Good for the Economy Amid Parliament Shutdown” – Patrick Boamah

- Ghana Parliament shutdown sparks economic fears

- IMF program delays expected

- $250M loan, key laws at risk

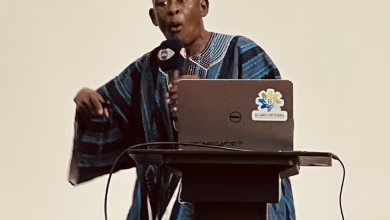

The Chairman of Parliament’s Finance Committee, Patrick Boamah, has warned that the indefinite shutdown of Parliament could severely impact Ghana’s economy. Speaking to JOYBUSINESS on the sidelines of the Annual IMF/World Bank meetings in Washington D.C., Mr. Boamah noted that the current development in the House could affect Ghana’s programme with the International Monetary Fund (IMF) in meeting timelines and conditions for disbursements.

“What is happening will not only affect a fraction of Ghanaians and Government, but everyone,” Mr. Boamah emphasized. He appealed to the Speaker of Parliament, Alban Bagbin, to prioritize national interest in addressing the current situation. “Being political on every matter will not help the economy now, and that is why I urge leadership of the House to consider all these implications.”

The shutdown follows Speaker Bagbin’s decision to adjourn proceedings indefinitely amid controversy over vacant parliamentary seats. This move was in response to the Supreme Court’s ruling to freeze his decision to declare four seats vacant.

Mr. Boamah revealed that key legislations, including the Environmental Protection Bill regulations, Ghana Investment Promotion Center Bill, and reforms in the Public Financial Management Action, are currently before the House. Additionally, a $250 million loan from the World Bank to support the financial sector hangs in the balance. Delays, he cautioned, would not be beneficial for the economy.

“The IMF and the World Bank have all been helpful in recent times to stabilize the economy, but we on our part are now failing to do the needful,” Mr. Boamah expressed worry.

Ghana recently received positive reviews from rating agencies regarding its creditworthiness following the Domestic Debt Exchange Programme and External Debt Restructuring. However, Mr. Boamah fears that the current development could reverse this trend, prompting investors to reassess their stance on the economy.

“Some of these reports could soon see these investors revise their notes about the economy,” he warned.

Despite the challenges, Mr. Boamah remains optimistic that Parliament can be recalled emergency-wise to address the backlog of issues. “I trust in the leadership of Parliament to effectively deal with the situation once things are getting out of hands.” He suggested considering weekend sittings, depending on leadership’s direction, to overcome the challenges.