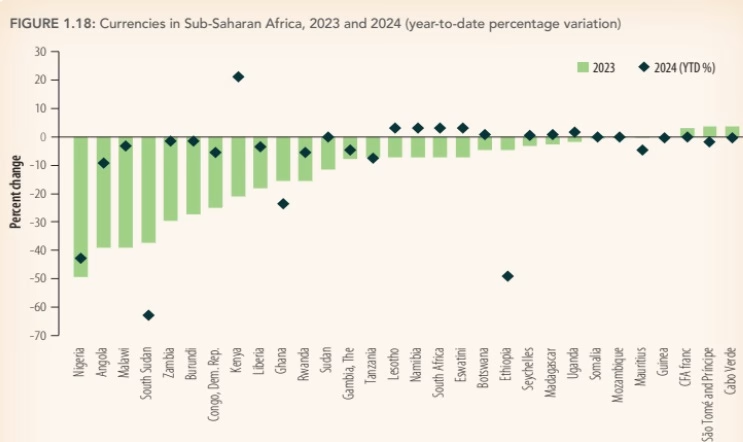

The World Bank’s October 2024 Africa Pulse Report has identified the Ghana cedi as one of the four worst-performing currencies in Sub-Saharan Africa (SSA) this year. According to the report, the cedi has lost approximately 24% of its value against the US dollar.

This significant decline places the cedi as the fourth weakest currency in SSA. The South Sudanese pound, Ethiopian birr, and Nigerian naira have fared even worse, with declines of over 60%, 51%, and 40%, respectively.

The report highlights that Ethiopia, Ghana, and Nigeria are among the countries with the worst-performing currencies in Africa this year. Their currencies continue to weaken due to pressing demand for foreign exchange.

In Ghana, the cedi’s depreciation is attributed to sustained demand for US dollars, limited dollar inflows, and slow foreign exchange disbursements to currency exchange bureaus by the central bank.

In Nigeria, the naira’s year-to-date depreciation stands at approximately 43% as of August 2024. Surges in demand for US dollars in the parallel market, driven by financial institutions and money managers, have contributed to the naira’s weakening.

In contrast, some currencies that weakened in 2023 have stabilized or strengthened this year. The Kenyan shilling is the best-performing currency in Sub-Saharan Africa, with a 21% year-to-date appreciation as of August 2024.

The South African rand and currencies pegged to it have also strengthened by 3.1% so far this year, following losses in the previous year.

Despite these positive trends, exchange rate pressures and foreign exchange shortages remain concerns for African policymakers.

The report notes that over one-third of the countries in the region will have less than three months of imports in international reserves by end-2024, based on data from 30 countries and two currency unions.

This highlights the need for continued monetary policy vigilance and strategic interventions to stabilize currencies and ensure economic growth in Sub-Saharan Africa.