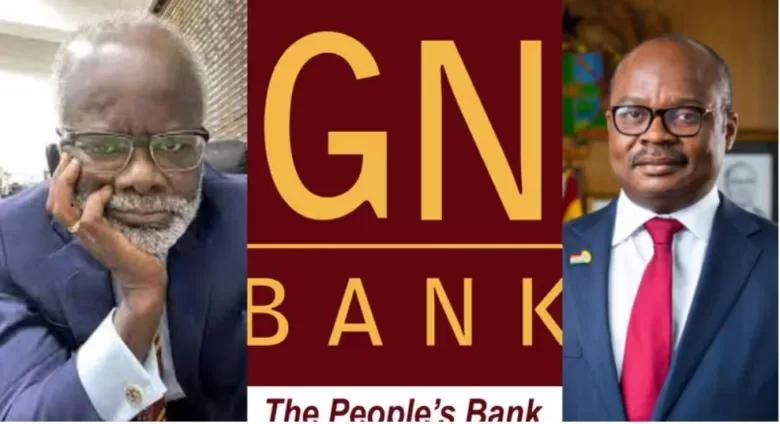

Groupe Nduom Fights Back Against Bank Of Ghana Takeover

- GN vehemently disputes BoG

- GN clarifies the distinction between GN Bank and GN Savings

- GN has appealed to high-ranking officials

Groupe Nduom (GN) is fiercely contesting the Bank of Ghana’s (BoG) decision to place GN Savings under receivership.

They claim the central bank’s accusations of financial instability are “wildly inaccurate” and are demanding the immediate restoration and upgrade of their license.

In a press release, GN vehemently disputes BoG’s claim that GN Savings has insufficient funds (less than GH¢30.33 million).

They argue that the Ministry of Finance (MoF) owes GN Savings and related companies a significant amount, far exceeding the BoG’s reported shortfall.

“GN Savings is not only solvent but would be highly liquid if the MoF simply paid its outstanding debts,” the press release states.

The crux of GN’s argument hinges on over GH¢7.1 billion owed by the Government of Ghana (GoG) and its agencies. GN maintains this sum would provide the necessary liquidity for GN Savings to function as a fully operational universal bank.

They question why BoG, aware of these outstanding debts, took such drastic action. The press release details how unpaid debts from COCOBOD, GETFund, and the MoF have severely impacted GN Savings’ financial health.

Compliance Concerns and Legal Action

GN asserts complete compliance with all BoG regulations. They claim a comprehensive report detailing their compliance and positive financial trajectory was submitted in June 2019.

However, GN alleges BoG never reviewed or discussed this report before revoking their license.

The press release outlines various compliance measures taken, including rebranding and branch rationalization, to meet BoG’s requirements for converting GN Bank to a Savings and Loans Company.

Distinguishing Between GN Bank and GN Savings

GN clarifies the distinction between GN Bank and GN Savings, refuting accusations of misconduct related to foreign currency transfers. They maintain that transactions involving International Business Solutions (IBS), a separate company established by Dr. Nduom, were legitimate and documented.

GN emphasizes that any issues pertaining to GN Bank should not impact GN Savings. They find it baffling that a government institution, aware of outstanding debts, would abruptly revoke their license without warning.

Seeking to rectify this situation, GN has appealed to high-ranking officials, including the President and Vice President, and is pursuing legal action to regain their license. They urge BoG to “correct its mistake,” highlighting the potential negative impact on financial inclusion and the closure of over 305 branches nationwide.