MP Warns of Additional GoldBod Losses in Bank of Ghana Accounts

- MP Dr. Gideon Boako warns of additional GoldBod-related losses beyond the $214 million reported by the IMF

- Losses are linked to the Bank of Ghana’s cedi–dollar–gold operations and multiple exchange rate system

- Six additional tonnes of gold held by the Bank may trigger further accounting losses

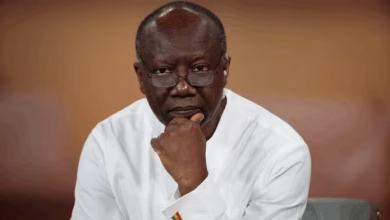

Tano North Member of Parliament, Dr. Gideon Boako, has warned that further losses related to GoldBod could soon appear in the Bank of Ghana’s audited accounts, beyond the $214 million already reported by the International Monetary Fund (IMF).

In an interview on Thursday, January 8, Dr. Boako highlighted that the IMF’s September 2025 report flagged trading losses from the Gold for Reserve programme and associated intermediation activities.

He cautioned that additional losses could emerge in the coming quarters once the Bank of Ghana’s official audit is published.

“The losses are coming from two streams. The $214 million reported is from GoldBod’s trading activities. But there is another component that will appear in the BoG’s audited accounts, and it is expected to be higher,” he said.

Dr. Boako explained that these additional losses are tied to the Bank of Ghana’s cedi–dollar–gold operations. He criticised the current system, under which the central bank collects cedis from commercial banks to buy gold at Bloomberg market rates, then holds the gold at an artificially lower valuation before selling dollars at the Bank’s official exchange rate.

He linked the new loss to six additional tonnes of gold currently held in the Bank’s vault. “Because the Bank is operating a multiple exchange rate system—a practice the IMF has criticised—it purchases reserve gold at higher Bloomberg rates but records it in its accounts at roughly 10 percent lower. This creates exchange losses when the audit is conducted,” he explained.

“The IMF report has noted that this approach is unsustainable and will continue to generate losses,” Dr. Boako added.

He concluded that the emerging figures point to structural policy challenges rather than flaws in GoldBod’s operational model. According to Dr. Boako, without reforms to the exchange rate framework, further financial pressure on the Bank of Ghana and GoldBod is inevitable.