Managing Ghana Petroleum Revenues for Real Development

- Ghana has earned $11.58 billion from crude oil since 2011

- Production peaked in 2022, but output has since declined

- Oil funds built Terminal 3, roads, schools, and pipelines, but daily life remains largely unchanged

Fourteen years after oil first flowed from the Jubilee field, Ghana has little to show for its petroleum windfall.

Since 2011, the state has earned about $11.58 billion from crude production, yet the sweeping transformation once promised remains out of reach.

Ghana’s share of oil revenue comes through several channels — royalties of 5% to 12.5%, surface rentals ranging from $30 to $100 per square kilometre, a minimum carried interest of 15%, a 35% corporate income tax, and various negotiated bonuses and entitlements with each operator.

These revenues reached their peak in 2022, when the government collected $1.43 billion, but output has since declined. Altogether, Ghana has produced about 675 million barrels of crude since 2010.

Today, the question is not whether petroleum has benefited the country, but how far those gains have gone.

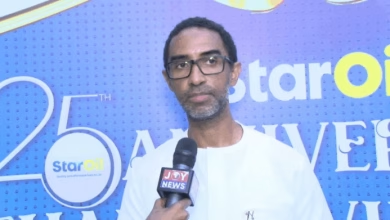

Through the Africa Extractives Media Fellowship (AEMF)—a project led by Newswire Africa and the Australian High Commission—Isaac Dwamena, coordinator of the Public Interest and Accountability Committee (PIAC), outlined how the state has managed its oil revenues. PIAC serves as an independent watchdog over the use of Ghana’s petroleum income.

Under the Petroleum Revenue Management Act (PRMA), all oil income is first paid into a central account, the Petroleum Holding Fund (PHF), before being distributed to key recipients.

- The Ghana National Petroleum Corporation (GNPC) has received about $3.15 billion to support operations and exploration.

- Around $2.6 billion has gone into the Ghana Stabilisation Fund, designed to cushion fiscal shocks.

- The Ghana Heritage Fund, reserved for future generations, has accumulated $1.1 billion and now holds roughly $1.3 billion.

The most tangible benefits have come through the Annual Budget Funding Amount (ABFA), which has absorbed about $4.5 billion since 2011. This fund supports the government’s yearly budget, making it the main channel through which citizens experience oil-financed development.

ABFA resources have financed flagship projects such as Kotoka Airport’s Terminal 3, the Kojokrom–Tarkwa railway, the Axim coastal protection works, the Tamne irrigation scheme, Free Senior High School, and the Atuabo gas processing plant.

Despite these visible investments, many Ghanaians still question whether oil wealth has translated into genuine improvements in daily life.

According to Dwamena, the problem lies in the absence of a clear, long-term framework for spending. Ghana still lacks a national development plan approved by Parliament to guide the use of petroleum revenues. Without such a roadmap, the country has pursued numerous projects simultaneously, spreading resources thin and creating inefficiencies, delays, and cost overruns.

A new shift is also underway in how oil funds are distributed. Under the 2025 budget, the government has directed 95% of ABFA resources into its Big Push programme for nationwide road construction, leaving just 5% for the District Assemblies Common Fund. It marks a sharp departure from previous years, when the ABFA was spread across multiple sectors.

Fourteen years after the first oil, the results remain uneven.

Ghana’s experience contrasts sharply with that of Norway, which invests its oil revenues through a massive sovereign wealth fund, channels nearly all investments abroad, and limits withdrawals to preserve wealth for the future.

Ghana’s own petroleum management rules—written more than a decade ago—now need fresh scrutiny.

Public consultation, expert input, and parliamentary review could help update the framework to reflect current economic realities and the global energy transition.

Citizens, having witnessed how their petroleum laws function in practice, must now ask whether the system truly delivers on its original promise.

For now, Ghana’s oil money has built airports, schools, and pipelines—but not yet the broad economic transformation that its discovery once heralded.