Gov’t Drops Duffuor Case After GH¢2B Repayment Deal

- AG cites risk of diminishing returns and desire to support financial sector reforms

- Ongoing litigation since 2020 deemed complex, with limited asset recovery

- Accused proposed structured repayment of GH¢2 billion out of GH¢3.3 billion liability

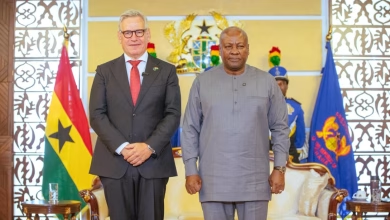

Attorney-General and Minister for Justice, Dr. Dominic Ayine, has outlined the rationale behind the government’s decision to discontinue the criminal case against former Finance Minister Dr. Kwabena Duffuor and seven others, citing a structured repayment deal and ongoing asset recovery efforts.

At a sectoral briefing on Monday, July 28, Dr. Ayine explained that the nolle prosequi (formal withdrawal of prosecution) was informed by significant progress in recouping funds and the legal complexities of the case.

He revealed that following extensive negotiations, the accused parties proposed a structured repayment of GH¢2 billion, as full and final settlement of their revised obligations, originally totaling GH¢3.3 billion. This arrangement involved a mix of asset transfers and collaboration to recover funds from third parties.

“By a letter dated May 7, 2025, the accused proposed to settle GH¢2 billion through a structured arrangement,” Dr. Ayine said.

The terms included:

- GH¢800 million in assets transferred directly to UniBank, now under receivership.

- Support in recovering GH¢1.2 billion from third-party recipients.

To date, GH¢844 million in landed properties has been handed over to UniBank, while GH¢500 million of the third-party recoveries has been retrieved. The remaining GH¢700 million is expected within 18 months, along with proceeds from asset sales.

Dr. Ayine emphasized that several key factors were considered in evaluating the proposal:

- Fictitious accounting entries totaling GH¢2.1 billion were made before UniBank’s official receivership.

- A GH¢300 million civil claim filed by the receiver in 2019 is still under insolvency litigation.

- Six years of prolonged legal battles produced limited recoveries due to asset-tracing challenges.

- Continued litigation risked diminishing returns, potentially undermining financial sector reform goals.

The discontinued criminal case—The Republic v. Kwabena Duffuor & 7 Others (CR/0248/2020)—stemmed from Ghana’s broader financial sector clean-up initiative, which aimed to recover public funds lost through mismanagement and hold those responsible to account.

Dr. Ayine reiterated that being charged with causing financial loss does not necessarily mean direct theft:

“It is important to clarify that causing financial loss to the state does not imply that the accused took the money for themselves.”