Ecobank Ghana PLC has approved a dividend of GH₵0.34 per share for eligible shareholders, following a stellar financial performance in 2024.

The bank recorded a revenue of GH₵5.4 billion and profit before tax of GH₵2.4 billion, reflecting an impressive 139.3% year-on-year growth.

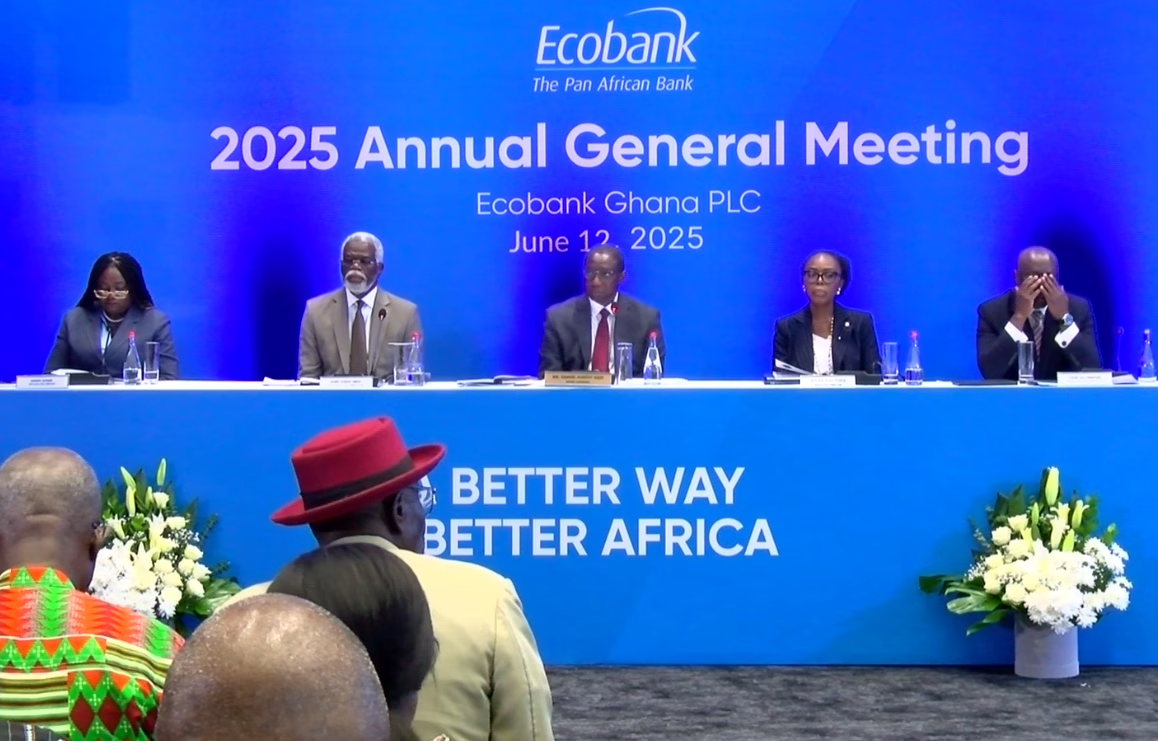

Board Chairman Samuel Ashitey Adjei attributed the results to the bank’s commitment to sustainability practices and cost-efficiency strategies.

“Our resilience in a volatile economic climate stems from a strong financial base, strategic direction, effective risk management, and diversified income streams,” Mr. Adjei stated.

Key financial highlights for 2024 include:

- Total assets surged by 36.7%, reaching GH₵46.0 billion.

- Capital adequacy ratio stood at 17.03%, well above the 10% regulatory minimum.

- Customer deposits rose by 23.2% to GH₵32.5 billion.

- Cost-to-income ratio remained efficient at 36.8%.

- Return on equity and assets hit 38.0% and 4.3%, respectively.

Mr. Adjei also emphasized Ecobank’s strategic investments in digital transformation, including upgrading its online banking platforms and deploying AI-driven solutions to improve customer service.

“We’re replacing outdated ATMs with advanced models, offering features like denomination selection and higher transaction limits,” he added.

Managing Director Abena Osei-Poku expressed optimism about 2025, citing the bank’s readiness to tap into emerging opportunities as the economy continues to recover.

“We’re focused on delivering continued growth and building a resilient, future-ready institution,” she said.

As part of its Corporate Social Responsibility (CSR), Ecobank invested approximately GH₵2.2 million in four educational institutions during the year.