AU Adopts Akufo-Addo’s Proposal to Expand Mobile Money Interoperability

- Akufo-Addo receives endorsement on his proposal to enhance mobile money interoperability across Africa

- The meeting emphasized the importance of harmonizing national and regional policies

- The endorsement of mobile money interoperability highlights the AU's focus on leveraging technology

The Sixth Mid-Year Coordination Meeting of the African Union (AU), held on July 21, 2024, in Accra, Ghana, marked a significant advancement in the continent’s economic integration efforts.

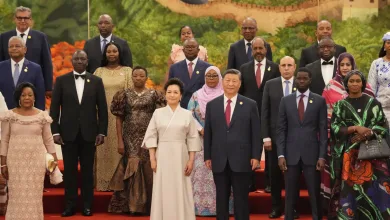

During this high-profile event, attended by Heads of State and Government from across Africa, Ghana’s President, H.E. Nana Addo Dankwa Akufo-Addo, proposed a landmark initiative to scale up mobile money interoperability throughout the continent.

Serving as the AU Champion on AU Financial Institutions, President Akufo-Addo underscored mobile money’s pivotal role in fostering economic integration and facilitating trade within Africa.

His proposal, titled “Scaling up Interoperability for Economic Integration: Using Mobile Money to Buy and Sell Across Africa,” received enthusiastic endorsement from the AU Assembly. This adoption represents a crucial milestone in the AU’s broader strategy to promote intra-African trade and economic cooperation.

By enabling seamless mobile money transactions across different countries and financial systems, the AU aims to reduce transaction costs, enhance financial inclusion, and facilitate smoother and faster trade activities among African nations.

Chaired by H.E. Mohamed Cheikh El Ghazouani, President of the Islamic Republic of Mauritania and Chairperson of the AU, the meeting highlighted the importance of harmonizing national and regional policies to drive socio-economic development across Africa. The endorsement of mobile money interoperability aligns with the AU’s objectives of promoting economic stability and fostering closer relations among member states.

President Akufo-Addo emphasized the transformative potential of mobile money interoperability, particularly for small and medium-sized enterprises (SMEs) and informal sector traders. He stated, “By leveraging mobile technology, we can break down barriers to trade, stimulate economic activities, and empower millions of Africans to participate more fully in the continental and global economy.”

The meeting declaration included a call for member states to allocate sufficient financial resources for the effective implementation of the integration agenda. The AU Commission, in collaboration with regional economic communities (RECs) and the African Development Bank (AfDB), was tasked with publishing a biennial Integration Report from 2025 onwards, to monitor progress and identify areas needing improvement.

The endorsement of mobile money interoperability by the AU signifies a significant commitment to harnessing technology for sustainable economic development in Africa. This decision is expected to spur further innovations in financial services and strengthen the continent’s integration into the global economy.