Ghana To Spend Between $600 and $800 million on External Debt Service In 2024

Ghana is projected to spend between $600 million and $800 million on external debt service in 2024, according to IC Africa Research. This amount includes an estimated $477 million for Eurobond debt service.

The research firm notes that the estimated cash flow on the restructured Eurobonds anticipates the resumption of debt service on these bonds from July 2024. “Accounting for ongoing multilateral debt service, we estimate that the authorities will require between $600 million and $800 million for external debt service in 2024,” IC Africa Research stated.

This estimate excludes the $1.6 billion in legacy arrears owed to Independent Power Producers, of which only $400 million has been paid, as well as other commercial creditors. The research firm also warned that Ghana’s debt service obligations will intensify from 2026 to 2030, with peak payments reaching $1.4 billion to $1.1 billion on Eurobonds alone.

Despite this, Ghana’s forex reserves stood at $4.3 billion in April 2024, equivalent to 2.0 months of import cover. IC Africa Research believes this suggests that the government has been accumulating reserves in anticipation of external debt service resumption rather than providing sufficient foreign exchange market support. As a result, the firm remains bearish on the outlook for the Ghanaian cedi, citing limited sources of sizable foreign exchange inflows to the market.

“We think the authorities would require between $600.0 million – $800.0 million for external debt service in 2024. These estimates exclude the $1.6 billion legacy arrears owed to the Independent Power Producers, out of which only $400.0 million has been paid, and other commercial creditors,” IC Africa Research noted.

“Extending the outlook, the cash flow forecast shows intensified debt service obligation from 2026 – 2030, from peak $1.4bn to $1.1 billion on the Eurobonds alone,” it added.

IC Africa Research Expects Limited Upside for Ghanaian Eurobonds

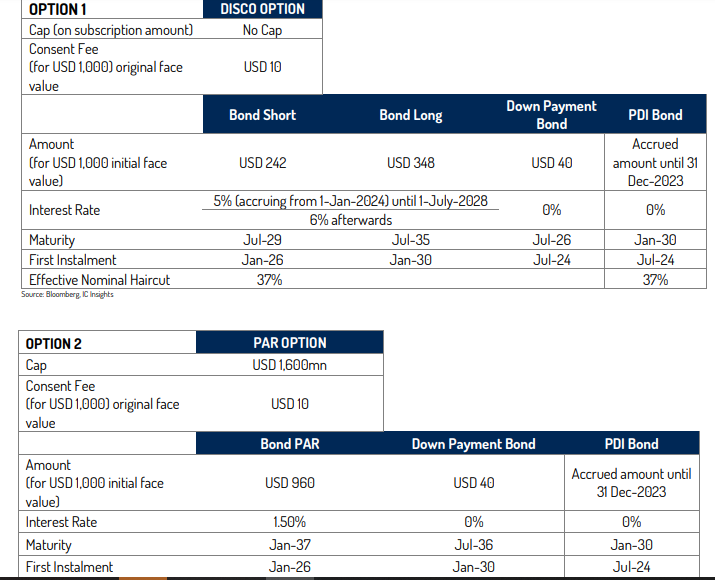

Following the significant restructuring of Ghana’s Eurobonds, IC Africa Research believes that the potential for further price increases in the secondary market is limited. The research firm had previously anticipated upside potential of 10-20% in early May 2024, but the actual price gain as of June 24, 2024, was only 3.8%.

The new terms of the restructured Eurobonds impose significant losses on investors, including principal haircuts, reduced coupon rates, and extended payment periods. As a result, IC Africa Research now sees limited upside potential from the current average market price of $53.4 per $100 face value, with potential gains of only 5-7%.