Nduom Urges BoG to Restore GN Bank’s License and Assets

- Dr. Nduom urged Dr. Addison to reconsider and reinstate GN Bank's banking licence

- He stressed the importance of preserving GN Bank's assets

- Dr. Nduom highlighted the substantial employment potential of GN Bank

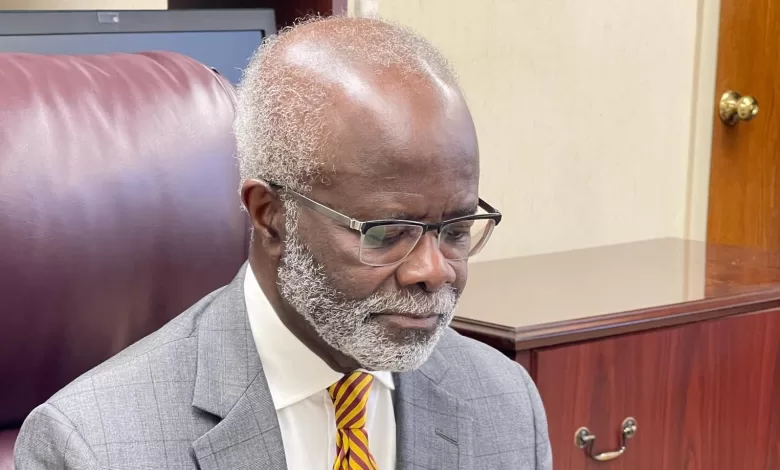

Dr. Kwesi Nduom, owner of the now defunct GN Bank, appeals passionately to Dr. Ernest Addison, Governor of the Bank of Ghana (BoG), requesting the reconsideration of their banking license and the return of seized assets following the bank’s insolvency.

Dr. Nduom’s plea emphasizes the readiness of GN Bank to resume operations, asserting that its assets remain viable despite previous regulatory actions.

In 2018, BoG undertook measures to consolidate the banking sector, leading to the revocation of licenses from several financial institutions, including GN Bank.

BoG defended its decision in June 2019, citing significant regulatory breaches and non-compliance with financial standards that compromised GN Bank’s operational stability.

Dr. Nduom disputed these claims in a recent Facebook post, presenting evidence from a 2019 transition report indicating sufficient funds contrary to BoG’s assertions of capital inadequacy.

He urged Dr. Addison to review these new facts and facilitate the return of GN Bank’s license and assets, highlighting the potential to reinvigorate the bank’s extensive branch network and contribute to financial inclusion.

Dr. Nduom envisioned the reinstatement of thousands of jobs and the revitalization of hundreds of branches through GN Savings, poised to resume operations as a savings and loans company.

He lamented BoG’s neglect of GN Bank’s assets, including various properties, despite proposals to utilize them to bolster capital reserves.

The plea underscores Dr. Nduom’s commitment to restore GN Bank’s operations, appealing for BoG’s recognition of new evidence to facilitate the bank’s resurgence in Ghana’s financial landscape.