The Ghana Chamber of Bulk Oil Distributors (CBOD) wants to calm Ghanaians worried about a drastic rise in fuel prices by the end of April.

The Chamber says their analysis shows factors affecting fuel prices, especially the exchange rate, have been stable recently. This means prices of petrol, diesel, and LPG might not increase significantly.

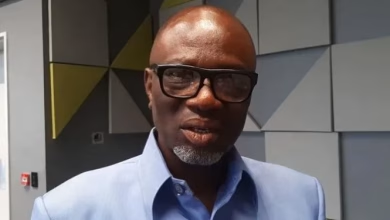

CBOD CEO, Dr. Patrick Kwaku Ofori, denied reports that petrol and diesel would reach GHS18 per litre by next week.

“The dollar exchange rate has been more stable than previous weeks, despite fears it would reach GHS14. It’s currently GHS14.99 per litre. It would only hit GHS18 if the dollar goes to GHS15, which I don’t see happening even next week,” he said.

Dr. Ofori urged the public and “energy experts” to stop making unverified predictions. These predictions can scare consumers and affect investment in the fuel sector.

The Chamber is concerned about how these speculations affect customer behavior and fuel price volatility. They plan to train journalists on fuel pricing and market dynamics to reduce misinformation.

“We need to be careful about what we say. Foreign exchange commodities are sensitive to important factors in the sector and the economy. When people make speculative predictions, we need to ask more questions,” he said.

Fuel prices had been stable for months, but have increased repeatedly in the last four weeks. Analysts blame this on rising international prices and a weaker Cedi compared to the US Dollar.

Currently, petrol and diesel prices average GHS14.99 and GHS14.80 per litre.

Dr. Ofori said the Cedi’s performance against the Dollar and international market prices are the main reasons for recent fuel price hikes. The Chamber is looking for new ways to get foreign exchange and reduce pressure on the Cedi.

He also addressed claims that bulk oil distributors profit from fuel price increases. Dr. Ofori said bulk distributors can sometimes lose money if their predictions about the foreign exchange market are wrong.

Looking at the international situation, Dr. Ofori expressed concern that tensions in the Middle East could affect global fuel prices if the conflict between Israel, Iran, and Gaza worsens.

“We don’t want the situation to escalate. If it does, we can be sure oil prices will rise,” he said.